Mango makes its debut as sponsor of the Trofeo Conde de God� and dresses over 400 members of the organisation

WEBWIRE – Friday, April 14, 2023

- The company will be responsible for dressing all tournament staff over the next three years, including ball boys and girls, line judges and umpires, as well as members of the organisation.

- Mango is also beginning its first year as technical sponsor of the tournament with the launch of a new capsule collection inspired by tennis, as well as the design of the first-line merchandising of the tournament.

- The sponsorship is part of Mangos commitment to develop closer ties with the regions in which it is present.

Mango, one of Europes leading fashion groups, is making its debut as the new technical sponsor of the Barcelona Open Banc Sabadell – 70 Trofeo Conde de God tennis tournament, by dressing more than 400 members of the organisation and the tournament staff, including ball boys and girls, line judges and umpires, who will participate in the tournament and be present on the playing courts, wearing garments that stand out for the quality of their materials and finishes, as well as their exclusivity and comfort.

The uniforms of the ball boys and girls, line judges and umpires include garments such as polo-shirts, windbreakers, sweatshirts, technical trainers and caps as part of their uniform, whereas members of the organisation, such as hostesses or access personnel, will feature garments such as tailored jackets, shirts, trench coats and gilets in their attire.

Inspired by the classic clothing of tennis clubs, the Mango collection for the God staff has been produced using mainly technical and functional fabrics such as Coolmax, Solotex, viscose and materials with thermo-regulating and breathable properties such as wool and cotton. What is more, the garments have finishes that are quick-drying and resistant to water, wind and odours.

Key garments in the collection include the iconic Ikaria trench coat and the Bologna pinstripe trousers, produced using Italian fabrics. Other key garments include the Flor and Murphy pinstripe suits, made of fabrics sourced from Barcelona.

Mangos technical sponsorship also coincides with the launch of a new capsule collection of products inspired by tennis, and the design of the first-line merchandising of the tournament. Specifically, the company based in Palau-solit i Plegamans (Barcelona) has designed a capsule collection called Mango Tennis Club, with polo shirts, skirts and shorts with retro details inspired by tennis, in addition to tennis shoes, which it has put on sale in selected stores and on its website.

In parallel, Mango has developed the first-line merchandising of the Barcelona Open Banc Sabadell. Alongside RCTB-1899 (the tournament owner) and Tennium (the tournament organiser), the company has designed and produced a collection of fashion garments and accessories for the sports event, including t-shirts, sweaters, caps, socks and wristbands, which it has put on sale in the official store of the trophy.

Mango, sponsor of the Barcelona Open Banc Sabadell

Last October, Mango signed an agreement with Real Club de Tenis de Barcelona-1899 to become the new technical sponsor of the Barcelona Open Banc Sabadell 70 Trofeo Conde de God tennis tournament until 2025.

The inclusion of Mango within the pool of sponsors of the Barcelona Open Banc Sabadell is part of the groups commitment to develop closer ties with the regions in which it is present. Through this agreement, Mango is supporting the cultural, social and economic activity of the Barcelona, and resuming the collaboration it had with the tournament between 2011 and 2013.

About Mango

Mango, one of Europes leading fashion groups, is a global company with design, creativity and technology at the centre of its business model, and a strategy based on constant innovation, the search for sustainability and a complete ecosystem of channels and partners. Founded in Barcelona in 1984, the company closed 2022 with a turnover of 2.688 billion euros, with 36% of its business originating from its online channel and with a presence in over 115 markets. More information atmangofashiongroup.com

S.A.F. Special Steel PCL (SET: SAF), one of Thailand’s leaders in high-grade steel supplies and vacuum hardening services, today made a trading debut on the Stock Exchange of Thailand (SET) Market for Alternative Investment (MAI). SAF’s entry in the industrial products segment came on the heels of a successful initial public offering (IPO) of 80 million shares at 1.93 baht per share. Mr Pisit Ariyadejwanich, Chief Executive Officer of SAF hailed the SET Market for Alternative Investment (MAI) debut as a crucial milestone in the firm’s 30-year-plus history, marking a new chapter in business expansion. “This is an important step and the pride of the management, team members, and all stakeholders who have contributed to this remarkable success,” he said. With the MAI listing, SAF is targeting growth in the country’s three main industries, namely automotive parts, construction materials, and food. It is prepared to expand by building the new warehouse and setting up the nitriding furnace system, as well as seek growth opportunities in the CLMV countries which includes Cambodia, Laos, Myanmar, and Vietnam. SAF is ready to capitalize on its experience and expertise of more than three decades in the sales of special-grade steel and providing vacuum heat treatment services. SAF has been entrusted as the distributor of high-quality special steel from leading German brands such as DORRENBERG EDELSTAHL GmbH and WILHELM OBERSTE-BEULMANN GmbH. The company is committed to delivering innovative products and high-quality services, improving the efficiency of human resources and completing operational processes, as well as following good Environmental, Social, and Governance (ESG) guidelines. The three key industrial sectors that SAF will focus on, with potentially significant growth are: The company will focus on expanding its customer base by offering hardening services together with mold steel selling, launching new products, and participating in bidding for various public and private projects. Concurrently, SAF is also looking for opportunities to expand into ‘New S-curve’ industries such as electric vehicles (EV), as well as expanding its business to CLMV countries. Furthermore, SAF will seek authorization from German partners to be the exclusive distributor of special grade steel products in those countries. In addition, the company has targeted on achieving an annual growth rate of 23-28% during 2023 to 2024 in line with the increased inventory capacity and the addition of nitriding hardening services, of which, enable SAF to respond to customers better and more comprehensively. Miss Veeraya Sriwattana, Head of Investment Banking CGS-CIMB Securities (Thailand) Co., Ltd., lead underwriter of the SAF new share issue, said the firm’s MAI listing would boost its business potential and enhance capital strength to support the business expansion plan. According to the company’s goals, this consists of increasing its warehousing capacity to 4,000 tonnes, with the expansion of the SAF3 warehouse, and investing in a nitriding furnace system to provide a one-stop hardening service for industrial customers. She also said that with SAF’s leadership in the business of special grade steel, the potential to grow continuously along with the targeted industries, and the management team’s vision and experience will make SAF a quality stock for investors in the Thai capital market. S.A.F. SPECIAL STEEL PCL (SAF), https://www.saf.co.th/en/ [SET: SAF] [SET: SAF/F] [SET: SAF-R]. Released for S.A.F. Special Steel PCL by MT Multimedia Co Ltd FS makes his third day of visit to Davos, Switzerland (with photos/video)

*************************************************************************

In the morning, Mr Chan attended a breakfast meeting on the theme of “Hong Kong Perspectives: Connectivity in an Evolving World”, co-organised by the Hong Kong Special Administrative Region (HKSAR) Government and the Hong Kong Exchanges and Clearing Limited. In his speech, Mr Chan pointed out that with the unique advantages under “one country, two systems”, Hong Kong serves as the bridge between the Mainland and the rest of the world in many areas such as finance, professional services, aviation, transport and logistics, as well as arts and culture. As convenient access to the Mainland and the world has fully resumed, Hong Kong now stands at a new start with ample opportunities of development. The HKSAR Government is actively attracting enterprises and talents to come to Hong Kong, seeking to upgrade and nurture industries, and it welcomes friends from all over the world to Hong Kong to explore development opportunities. The 70 or more participants included senior management personnel of multinational companies, business leaders, entrepreneurs and representatives from the financial and investment sectors.

At noon, Mr Chan attended the Informal Gathering of World Economic Leaders luncheon.

He also respectively met with the Secretary-General of the Organisation for Economic Co-operation and Development, Mr Mathias Cormann, as well as Member of the World Economic Forum Executive Committee and Head of Internet of Things and Urban Transformation Platform, Mr Jeff Merritt. They exchanged views on the global economy, technological development, etc.

Meeting the senior management of a multinational company and founder of a start-up company, Mr Chan encouraged them to capitalise on Hong Kong’s strengths in connectivity and explore the global market.

Mr Chan will continue his visit to Davos today (January 19, Davos time).

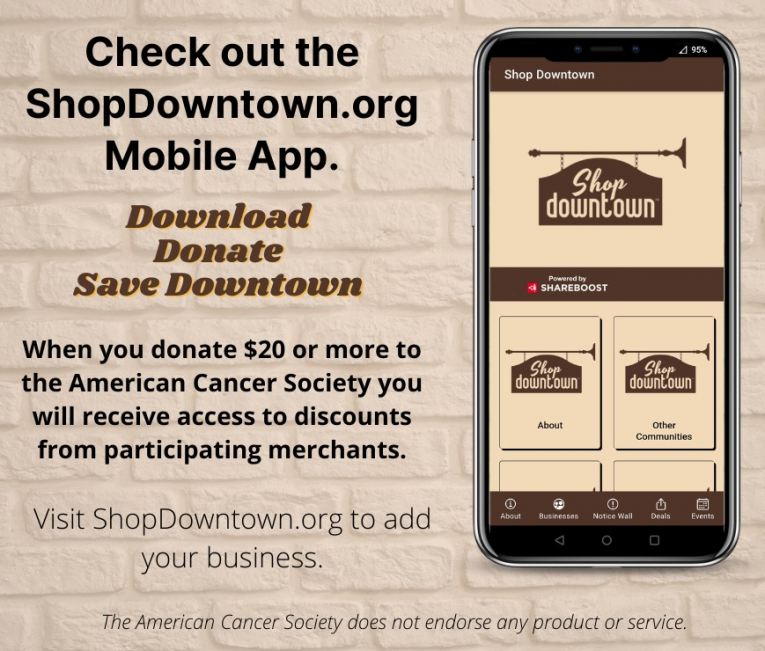

Shufti Pro, the leading provider of AI-powered end-to-end identity verification, eKYC, KYT, and AML solutions, has been nominated at the Ultimate Fintech Awards MEA 2023 under the categories of “Best Fintech AI Solution,” “Best Regtech Reporting Solution” and “Best Client Onboarding Solution.” Honouring excellence across the Middle East and Africa, Ultimate fintech’s main focus lies in driving ROI by connecting the brands to the right audience through a customised range of services in marketing, events and PR. While Shufti Pro, an AI-powered KYC/AML service provider, has been catering to the IDV needs of 100s of customers worldwide since its inception in 2017. You can show your support for Shufti Pro by voting in the category of “Best Fintech AI Solution,” “Best Regtech Reporting Solution,” and “Best Client Onboarding Solution” at the provided link. Voting lines are open until Jan 10, 2023, while the winners will be announced on Jan 18, 2023, in the awards ceremony to be held at iFX Expo Dubai. Expressing his thoughts about being nominated, the CEO of Shufti Pro, Victor Fredung, said, “The nomination in the upcoming Ultimate Fintech Awards MEA 2023 validates our efforts in providing automated and configurable Fintech, Regtech and client onboarding solutions. In a time where online scams are skyrocketing in the financial sector, providing cutting-edge Fintech and Regtech services is our top priority. This nomination has encouraged the Shufti Pro team to strive even harder towards providing seamless identity verification solutions to our global customers.” Shufti Pro has recently won “Best Financial Technology Provider UK 2022” and two International Business Magazine Awards 2022 for providing world-class ID verification services. The company has also won “Top RegTech Startups” under the category of “Emerging Startups 2022.” Shufti Pro also won “Best Digital KYC/Onboarding Application UAE 2022” and “Best Digital KYC/Onboarding Application Europe 2022” at Global Business Reviews Magazine Awards 2022 for its market-competitive identity verification solutions. About Shufti Pro Shufti Pro Categories New Shopping App Supports Nonprofits By Turning Popular Merchant Discount Card Promotions Into Convenient Mobile App Shopdowntown Post MEDFORD, Ore. – Nov. 29, 2022 – PRLog — Shop Downtown, a leading provider of digital downtown city-based merchant discount cards, today unveiled a new way for nonprofits to fundraise via the firm’s new mobile app, available on Google Play and the Apple App Store, just in time for this year’s Giving Tuesday. The new Shop Downtown app presents a unique opportunity for non-profits. Here’s how it works: shopdowntown.org offers nonprofits a way to fund their own projects by selling ad space on the App to downtown businesses and sharing in the annual revenue created. A non-profit that signs-up fifty local businesses stands to make up to $10,000 per year for their cause. “We see the affiliation with local non-profits as a community-minded way to grow our footprint in cities and towns across the country,” said Wells. The new fundraising platform offers participating organizations digital consulting, nonprofit formation, Google Ad grant application support, and a bevy of other features designed to make the process easy and transparent. Additionally, the firm can white label and automate the creation of digital discount programs (https://shopdowntown.org/ About the app: Available for iOS (Apple App Store (https://apps.apple.com/ How it works: Downtown businesses pay $400 per year, a little over $33 per month, for ad space on the app and in the directory. For that investment, businesses are listed in the app directory with their logo; contact information including, phone, email and directions; links to the business’s website and social media accounts which drives traffic to local stores. The backstory – evolution of the app: In 2013, Wells’ wife Heather opened a yarn shop in downtown Medford, Oregon. To help support the shop and other neighboring downtown businesses, the Wells started shopdowntown.org to offer shoppers a tangible discount for patronizing local businesses. First focused on Medford, Daniel Wells quickly began creating a database of downtown business directories nationwide. Wells expanded the footprint of the domain to create a directory of shops, restaurants and hotels for every City in the United States, Canada, Australia, New Zealand and the UK. At the same time, Eric Reimer and his partner Sean Nielsen were building a company to help small businesses, downtown communities and non-profits create their very own custom Mobile Applications. While doing their research, Reimer and Neilson encountered shopdowntown.org, which appeared at the top of most Google searches for downtown businesses, and immediately contacted Wells. In short order, they were collaborating and the new shopdowntown.org mobile app is the result.SAF makes SET Market for Alternative Investment (MAI) debut, embarks on a growth plan to accentuate leadership in special grade steel business

SAF’s leadership in special grade steel, and potential to grow with target industries, and the management team’s experience and vision will make SAF a quality stock for the Thai capital market. [Image: SAF]

– Automotive parts industry using special grade steel to make molds and dies to produce parts for automobiles, motorcycles, as well as agricultural machinery vehicles

– Construction materials industry using special grade steel to make dies to produce aluminium profiles for window and door frames, machinery parts in the production of cement and steel for construction works

– Food industry using special grade steel to make molds and dies to produce pans, pots, LPG cylinders, cans, and packaging bottles, and machinery parts in the sugar cane production process, and so on

Pipop Khongwong (‘Top’), T. +66-81-929-8864, E: pipop.k@mtmultimedia.com.

Topic: IPOHong Kong – FS makes his third day of visit to Davos, Switzerland (with photos)

The Financial Secretary, Mr Paul Chan, made his third day of visit to Davos at the World Economic Forum Annual Meeting (January 18, Davos time).Shufti Pro Makes It to the Ultimate Fintech Awards MEA 2023

Shufti Pro is a leading identity verification service provider offering KYC, KYB, KYI, AML, and OCR solutions that are accelerating trust worldwide. The UK-headquartered company has six international offices and has launched a suite of 17 complimentary IDV products and solutions since its inception in 2017. With the ability to automatically and securely verify over 9000 ID documents in more than 150 languages, Shufti Pro proudly serves customers in 230 countries and territories.

Graeme Rowe

+1 781-229-5841

shuftipro.com![]() Contact

Contact

Shop Downtown App Makes Giving Tuesday A Year Round Event