ANI.Finance, the Blockchain-to-Business DeFi Startup, Announces a Private Sale

New York, NY, May 24, 2022 – (ACN Newswire) – After getting seed round investments, DeFi startup ANI.Finance announced it opens up for the first private sale among a bigger number of investors. Private sale starts on 05/30/2022. For now, users can sign up to get the priority spot among other investors.

In a private sale operation for strategic investors, the project will launch its native token ($ANIF). The cryptocurrency will run on Binance Smart Chain (BSC) and, later, will use multichain Polkadot solutions. $ANIF will have a supply of 1 billion tokens.

The initial circulating supply will be equal to 62.25 million $ANIF, and the token will have a dual utility:

- It will grant access to a reward system

- It will give governance rights in terms of supporting upgrades to the project’s ecosystem

The majority of the token (69%) will provide incentives to the nodes of the system.

ANI.finance is developing a multichain framework to cut the cost of building and integrating blockchains. The project will bring a cross-platform, paperless and transparent approach to app development, retail, travel, manufacturing, gamedev and intellectual property. It will bring a balance between centralized and decentralized solutions so that the Blockchain/DeFi industry gets a strong push forward towards a wider adoption.

The team promises following features:

- Low transaction costs: ANI promises to offer lower transaction fees by distributing resources.

- Decentralized systems optimization: ANI makes use of centralized to optimize this framework.

- Business process automation: this system wishes to create the occasion for saving business resources.

- Service delivery at high speed: in terms of scalability, ANI aims to launch a fast system for small and large businesses.

According to a roadmap, in the next move ANI Team will be working on kicking off the public sale of the $ANIF token. Another complementary work-in-progress ANI project consists of an NFT game with stacking features. $ANIF is meant to be a gas for game’s ecosystem.

More info about ANI and $ANIF token is available in their whitepaper.

Media Contact

Carly Hans, community manager, ANI.Finance

Email: partner@ani.finance

URL: https://ani.finance/

SOURCE: ANI.Finance

Topic: Press release summary

Aurora Finance Introduces The Major Auto-Compounding Protocol

The team at Aurora Finance, an auto-compounding protocol, is pleased to announce the introduction of its protocol. Aurora Finance offers the highest fixed APY in cryptos (up to 383,025.81%) and low risk with Aurora Insurance Fund (AIF). The interest is paid every 15 minutes, which means, users are paid 96 times daily. Aurora Finance has an anti-dump daily limit to prevent price depreciation.

The $AURA Token

$AURA is the platform’s native token that supports the operation of the ecosystem. The token provides benefits and value to token holders, as rewards are automatically paid to every eligible participant every 15 minutes. In other words, all token holders are automatically rewarded with high compound interest every 15 minutes as long as the tokens are still in your wallet.

$AURA has other use cases, including:

- Interest is auto compounded instead of continually re-staking your assets to generate revenue.

- Since $AURA is in your wallet, there are no third-party interferences. Plus, any complicated staking procedures are eliminated.

Aurora Insurance Fund (AIF)

Aurora Insurance Fund is a special wallet within the project’s ecosystem. This wallet backs the reflection rewards that are distributed to token holders every 15 minutes. The wallet holds 5% of all the trading fees to sustain the operations of the platform. At its core, Aurora Insurance Fund keeps token holders safe by avoiding flash crashes through price stability. It also helps reduce downside risk.

Aurora Treasury

In the event of extreme price drop on the market, the treasury is meant to provide support to the AIF. Aurora Treasury also funds other projects in the metaverse and boosts the team’s marketing efforts.

How to Buy $AURA?

The process of buying and holding $AURA is not complicated, provided you are on Avalanche C-Chain. To get started, follow these steps:

- Send AVAX to your wallet from any centralized exchange (example Binance).

- Visit Bogged.Finance and enable the Autotax option by setting it to 15%.

- Once you confirm AVAX in your wallet, swap the assets to USDC.e on Bogged.Finance. Keep some AVAX in your wallet to pay for transaction fees.

- Still on the Bogged.Finance platform, use your USDC.e to purchase $AURA.

Users can also buy from “Trader Joe” platform in alternative to Bogged Finance.

Audited by Solidity Finance

Aurora Finance has been duly audited by Solidity Finance, a renowned audit firm in the blockchain space. With the audit fully completed, the project is now certified safe for investors looking for a safe haven to invest their savings and hard-earned money. The details of the audit are contained here.

About Aurora Finance

Aurora Finance is the highest paying auto-compounding protocol. The project provides a decentralized financial asset that rewards users and token holders with continued fixed compound interest through its unique ARP.

DexScreener: https://dexscreener.com/avalanche/0x6cB064CE0543315d83b01B0958E968C916Fc642B

Solidity Finance: https://solidity.finance/audits/AURA/

Social Media Handles:

Twitter: https://twitter.com/AURAuroraFi

Telegram: https://t.me/AuroraFinance

Discord: https://discord.gg/FpFDJx2ejG

Contact Info:

Organization: Aurora Finance

Website: https://aurora.finance

Tower Finance Announces the Launch of Algorithmic Stablecoin: the New Holy Grail for Defi 2.0

Recently, Tower Finance is proud to announce the Launch of its Algorithmic Stablecoin. Algorithm-based stablecoins are new variants of cryptocurrency tailored for offering improved price stability. In the current market today, more and more users have taken interest, as it can also help in balancing the supply and demand of the asset in circulation.

Algorithmic Stablecoin Protocol, developed by Tower Finance, looks to offer considerably improved capital efficiency in comparison to collateralized stablecoins.

What is Tower Finance?

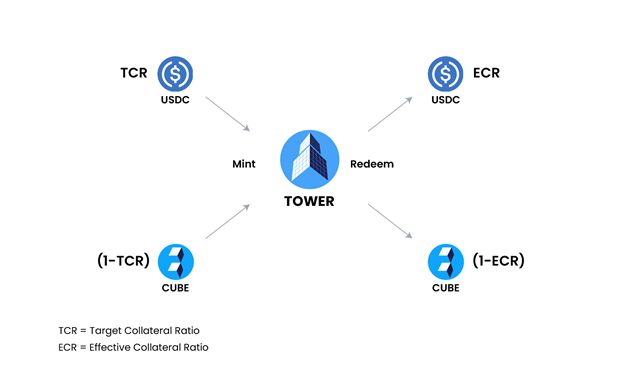

The Tower Finance is a Fractional-Algorithmic Stablecoin, soft-pegged to the U.S. Dollar, built on the Polygon network. The protocol plans to maintain TWR price stability by storing sufficient collateral in the time locked-smart contracts. The USDC is deposited into the protocol when a user mints TWR token, while the CUBE token, which is used for minting, is burned. When the user redeems TWR tokens, the protocol pays back USDC and mints the required amount of CUBE tokens. This allows arbitrageurs to help maintain price stability.

Aiming to solve the ‘Stablecoin trilemma’

Tower Finance aims to provide a solution for the so-called ‘Stablecoin trilemma’ of decentralization, capital efficiency, and price stability by introducing TWR, its fractional-collateralized algorithmic stablecoin. Tower Finance aims to build an ecosystem that incorporates both collateral and high capital efficiency, hence developing stability.

By implementing a floating collateralization ratio, TWR not only maintains its peg in the most efficient manner possible, but it also captures value for CUBE holders and produces yield for its community of holders.

Implementing DeFi 2.0 through Protocol Owned Liquidity and Protocol Rented Liquidity

Tower Finance is the first algorithmic stablecoin protocol to adopt the ‘Protocol Owned Liquidity’ model introduced by OlympusDAO. While the structure is different, the underlying idea is similar. The protocol charges a penalty to users who terminate the vesting terms for the farming rewards. When this happens, the protocol uses 2/3 of the collected penalty for providing liquidity. Half of it is converted to USDC and used to provide liquidity. The leftover, which amounts to 1/3 of the collected penalty, is sent to the Profit Manager.

When TWR is minted with USDC and CUBE, the protocol doesn’t immediately burn CUBE. Instead, 50% of CUBE is sold to temporarily create a CUBE-USDC LP to provide additional liquidity. We call this ‘Protocol Rented Liquidity’, because the meant-to-be-burnt tokens are borrowed for a short period of time to add liquidity to Tower’s ecosystem until it is removed via governance decisions, in which case, the USDC is converted into CUBE and burned.

With a commitment for long-term sustainability yet a market fit, ultra high-yield/yield enhancement go-to-market strategy, it is perfectly destined to pave the way for stablecoin protocols in the era of DeFi 2.0

Tower Finance officially launches on Valentine’s Day: 14th of Feb, 6:00am UTC.

https://medium.com/@tower_finance/calling-all-towerians-the-time-has-come-2fa7fe9a24fc

Social Links

Twitter: https://twitter.com/tower_finance

Discord: https://discord.com/invite/KVTe6hRZK8

Medium: https://medium.com/@tower_finance

Github: https://github.com/towerfinance

Media Contact

Brand: Tower Finance

Contact Jeremy Parker, Head of Marketing

E-mail: jeremy@towerfinance.io

Website: https://towerfinance.io/

SOURCE: Tower Finance

Topic: Press release summary

Canada – Department of Finance consulting on draft tax proposals

The Department of Finance Canada today released for public comment a set of draft legislative proposals to implement previously announced and other tax measures.

February 4, 2022 – Ottawa, Ontario – Department of Finance Canada

Canada’s strong and essential social safety net is built on a robust national tax base.

The Department of Finance Canada today released for public comment a set of draft legislative proposals to implement previously announced and other tax measures.

Specifically, the proposals would implement Budget 2021 measures to:

Allow for the immediate expensing of up to $1.5 million of eligible investments by Canadian-controlled private corporations, sole proprietors and certain partnerships to help businesses invest in new technologies and move forward with capital projects, as further detailed in the backgrounder Expansion of the Eligibility for Tax Support for Business Investments;

Reduce—by 50 per cent—the general corporate and small business income tax rates for businesses that manufacture zero-emission technologies;

Expand access to the accelerated capital cost allowance for certain clean energy equipment and implement certain restrictions;

Improve access to the Disability Tax Credit;

Include postdoctoral fellowship income in “earned income” for Registered Retirement Savings Plan (RRSP) purposes;

Enhance Canada’s income tax mandatory disclosure rules, as further detailed in the backgrounders Mandatory Disclosure Rules and Income Tax Mandatory Disclosure Rules Consultation: Sample Notifiable Transactions;

Increase flexibility for plan administrators of defined contribution pension plans to correct for both under-contributions and over-contributions;

Improve the fairness of certain taxes applicable to Registered Investments;

Improve administration of, and compliance with, electronic filing and certification of tax and information returns;

Temporarily extend certain timelines for the Canadian Film or Video Production Tax Credit (CPTC) and the Film or Video Production Services Tax Credit (PSTC);

Combat the avoidance of tax debts through complex transactions that attempt to circumvent the tax debt collection avoidance rule;

Ensure that the Canada Revenue Agency (CRA) has the authority it needs to conduct audits and undertake other compliance activities; and

Limit the amount of interest and other financing expenses that businesses may deduct for income tax purposes based on a proportion of earnings.

The draft proposals would also implement measures announced in previous budgets to:

Enhance the tax reporting requirements for trusts in order to improve the collection of beneficial ownership information; and

Update rules that address tax planning relating to allocations to redeeming fund unit holders in the mutual fund industry.

Draft proposals would address an error in the current law for the COVID-19 GST Credit Top-up so that it is consistent with the original intent of the measure as announced in March 2020 by the Government of Canada and how it has been administered by the CRA. In addition, draft proposals would ensure the proper functioning of the revocation tax with respect to organizations that have their registration as a charity revoked due to being listed as a terrorist entity.

To clarify the GST/HST treatment of crypto asset mining, draft proposals would specify that crypto asset mining would generally not be considered a “supply” for GST/HST purposes. This would mean that the GST/HST would not apply to the provision of crypto asset mining and input tax credits would not be available to the person providing the mining.

Note that references to “Announcement Date” in the draft proposals, and the accompanying explanatory notes, refer to February 4, 2022. In addition to draft legislative proposals, sample notifiable transactions are detailed in the backgrounder Income Tax Mandatory Disclosure Rules Consultation: Sample Notifiable Transactions for the measure relating to mandatory disclosure rules.

Canadians are invited to provide comments on these draft proposals and the sample notifiable transactions. Please send your comments to Consultation-Legislation@fin.gc.ca.

Submissions on the following measures should be received by April 5, 2022:

Taxes applicable to Registered Investments;

Mandatory Disclosure Rules;

Avoidance of Tax Debts;

Audit Authorities;

Reporting Requirements for Trusts;

Mutual Funds: Allocation to Redeemers; and

Crypto Asset Mining.

Submissions specifically relating to the Interest Deductibility Limitation measure will be accepted until May 5, 2022.

Submissions on all other measures should be received by March 7, 2022.

Shortage.finance Adding Value to Users through Its Ethereum-backed Token

Shortage is one of the most recent projects in Q4 2021, creating a continuous backing for its token to help with its overall value in the long term. The project describes its token as a safe-haven asset, leveraging Ethereum as the backing currency. Notably, the straightforward nature of its ecosystem will be a beneficial factor to both starters and professionals in the industry today.

According to the project, its token is not suitable for trading or short-term investing. This factor is mainly due to its target to add more value as time goes by, incentivizing its holders to store the currency. It also assures users that there is no team to claim any portion of the supply or change the dynamics of how the token and its smart contract works. Anyone can confirm on etherscan.io that the team has transferred the ownership of the smart contract and 100% liquidity to the dead address. This fact further proves that the team has zero control over the project.

Moreover, it has no allocation of the token’s supply to marketing strategies, depending on the community to take up the task. Shortage believes that every holder can take a step to spreading the word about the token through social media, paid campaigns, and sharing to relatives or friends, among others.

Understanding RTG Tokenomics

The first unique thing to understand about the RTG token is that there will be no official presale. The project has a great focus on liquidity and burning the token during its existence in the industry. The whole concept surrounds reducing its supply while increasing its Ethereum backing.

RTG is an ERC-20 token with a total supply of 2 billion tokens. On December 27, the coin earned a listing on Uniswap V2, which will be the main exchange where you can acquire the coin. 50% of the total supply will go to liquidity locking, meant to remain locked forever. The other half will be burned to increase the scarcity of the token in the market.

Any transactions involving the RTG/ETH pair will incur a transaction fee of 10% from the total; that is from any purchase, sale, or transfer of the token. If you are a holder of the token, you can expect a share from 50% of all transaction fees; the rest will go to the burning address.

Holders do not have to go through a hassle claiming the rewards they earn from holding the token. All you need to do is get a wallet compatible with the pair, fund it, and acquire the tokens you wish. Make sure to set your slippage at 11% to complete all your orders efficiently.

Increasing the Value Holders Get

Currently, 50% of RTG’s total supply is already in the burn address, a move that many existing projects are employing to reduce the supply of their tokens. The basic law of supply and demand states that with reduced supply, demand increases. In the same way, projects wish to derive the most from the same concept by removing them from the circulating supply.

Additionally, when anyone buys or sells RTG on Uniswap V2, part of every transaction fee goes to burning. Also, ETH will replace the RTG tokens, increasing the backing of the Shortage tokens. As such, the backing will always be more than enough to cover the total circulation supply available for sale. As a result, the price floor increases after every RTG transaction.

Lastly, part of the Ethereum backing in the pool will not be withdrawable to ensure a constant boost after every transaction. In the long run, the fruits of this objective will be visible in making RTG a long-term investment option for its holders.

Twitter: https://twitter.com/Shortagfinance?s=20

Telegram: https://t.me/shortagechat

Reddit: https://www.reddit.com/r/shortagefinance/