Hong Kong – Hongkong Post to issue “The 10th Anniversary of the Belt and Road Initiative” commemorative stamps (with photos)

Hongkong Post to issue “The 10th Anniversary of the Belt and Road Initiative” commemorative stamps (with photos)

******************************************************************************************

Hongkong Post announced today (August 23) that a commemorative stamp issue and associated philatelic products on the theme of “The 10th Anniversary of the Belt and Road Initiative” will be released for sale on September 7 (Thursday).

The Belt and Road Initiative was raised by President Xi Jinping in 2013. Hong Kong has been proactively participating in the Initiative, serving as the functional platform and a key link, and works towards full integration into national development. Upholding the principles of extensive consultation, joint contribution and shared benefits, Hong Kong promotes high-quality development of the Initiative, capitalises on our strengths to meet the needs of our country.

Hongkong Post will issue a stamp sheetlet and associated philatelic products on the theme of “The 10th Anniversary of the Belt and Road Initiative” to mark this significant milestone.

On the same day, China Post, Macao Post and Telecommunications and Hongkong Post will jointly present a stamp booklet containing stamps and stamp sheetlets issued respectively by the three postal administrations to celebrate the 10th Anniversary of the Belt and Road Initiative together.

Official first day covers for “The 10th Anniversary of the Belt and Road Initiative” will go on sale at all post offices and on Hongkong Post’s online shopping mall ShopThruPost (shopthrupost.hongkongpost.hk) from tomorrow (August 24). This set of commemorative stamps and associated philatelic products will be on sale at all post offices and ShopThruPost from September 7, while serviced first day covers affixed with a $10 stamp sheetlet will be available at philatelic offices only.

A hand-back date-stamping service will be provided on September 7 at all post offices for official first day covers/souvenir covers/privately made covers bearing the first day of issue indication and a local address. Collection points will be set up at all post offices on the same day for submission of the covers requesting the hand-back date-stamping service.

Information about this set of commemorative stamps and associated philatelic products is available on the Hongkong Post Stamps website (stamps.hongkongpost.hk) and in the ShopThruPost mobile app.

Mitsubishi Heavy Industries, Ltd. (MHI) submitted a revised shelf registration statement to the Director-General of the Kanto Local Finance Bureau today in preparation for its planned issuance of transition bonds via public offering in the Japanese bond market. MHI was selected as a model example for the “2021 Climate Transition Finance Model Projects” being supported by the Ministry of Economy, Trade and Industry (METI) in March 2022, and issued its first transition bonds in September 2022. This will be our second issuance of transition bonds The Mitsubishi Heavy Industries Group has defined two growth areas: “Energy Transition”, which aims to decarbonize the energy supply side, and “Smart Infrastructure”, which targets to realize the decarbonization, and promote the energy efficiency, manpower saving in the energy demand side. As part of the financing necessary for focusing on businesses in these areas, and promote decarbonization, electrification and intelligence in its existing businesses, MHI is utilizing ESG finance such as transition bonds and green bonds. By issuing the bonds, MHI will diversify its financing methods, promote its energy transition initiatives, and contribute to realizing a Carbon Neutral society. For more information, visit www.mhi.com/news/23072801.html. About MHI Group Mitsubishi Heavy Industries (MHI) Group is one of the world’s leading industrial groups, spanning energy, smart infrastructure, industrial machinery, aerospace and defense. MHI Group combines cutting-edge technology with deep experience to deliver innovative, integrated solutions that help to realize a carbon neutral world, improve the quality of life and ensure a safer world. For more information, please visit www.mhi.com or follow our insights and stories on spectra.mhi.com.

Copyright ©2023 JCN Newswire. All rights reserved. A division of Japan Corporate News Network. FEHD clarifies issue of construction waste at Devil’s Peak

**********************************************************

The spokesman said that the FEHD had contacted the DC member concerned to understand the matter and launched an investigation. According to the department’s work records, no staff had been deployed to remove illegal structures or to clear relevant construction waste at the said location, and in fact those tasks fall outside the FEHD’s area of responsibility. Therefore, the department reckons that the incident is merely a misunderstanding.

The FEHD has referred the abovementioned report from the public to the Lands Department (LandsD) for follow-up investigation, and understands that the LandsD will arrange contractors to remove relevant construction waste as early as practicable. The FEHD will continue to monitor the location concerned to see if there are any other environmental hygiene problems that need to be addressed.

Hongkong Post to issue “Dinosaurs” special stamps (with photos)

*************************************************************************

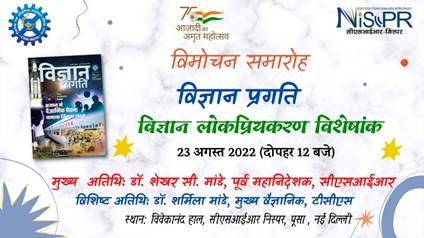

CSIR-National Institute of Science Communication and Policy Research (CSIR-NIScPR), New Delhi organized the release function of the Special issue of its Popular Science Hindi magazine “Vigyan Pragati” on 23 august 2022. In the year 2022, this popular magazine of NIScPR has completed the glorious 70 years of spreading science among the public. The very first issue of this magazine was published in August, 1952. This special issue (August 2022) of ‘Vigyan Pragati’ contains India’s leading organisations engaged in science popularization. Both government and voluntary organisations have been covered in this special issue. This programme is the part of Azadi Ka Amrit Mahotsav.

Release of the Special issue of ‘Vigyan Pragati’ magazine focused on the Indian organisations engaged in science popularisation

The event started with lighting the lamps as a gesture of demolition of the darkness of misinformation with the light of scientific knowledge. Prof. Ranjana Aggarwal, Director, CSIR-NIScPR warmly welcomed the Chief guest Dr. shekhar C. Mande and the Guest of Honor Dr. Sharmila Mande. In her address, she described the rich legacy of the science magazine ‘Vigyan Pragati’ and CSIR-NIScPR’s contributions towards science popularisation. She added that science is not a sole part of western culture. India has been practicing science since ancient times and has a rich scientific legacy and traditional knowledge of our nation. She also mentioned Acharya P.C. Ray, for playing an important role in science popularisation in the nineteenth century.

Guest of Honour Dr. Sharmila Mande, Chief Scientist, TCS Research & Innovation, highlighted the role of science communication in regional languages. She added that in this way, innovations in the field of Science and Technology can reach out to larger population of the society. Chief Guest Dr. Shekhar C. Mande, former Secretary, DSIR & former Director General of CSIR emphasized the role of science and scientific temper in the progress of the nation. He was concerned about the general perception of people towards science, despite having a rich scientific history. He mentioned that there still is a gap between the scientific community and society. He said that science is not finished until it’s communicated. Further, he stressed on historical achievements of CSIR institutions for the betterment of society. He said always there have been tough times for science whether it was the colonial period or the challenging time of COVID pandemic or any natural disaster, CSIR never stepped back from its responsibility. One may not know about the contributions of CSIR but unknowingly CSIR is part of everyone’s daily life. Dr. Shekhar recalled the contribution of ‘Vigyan Pragati’ in the last 70 years and told this magazine and its popular science content should reach aggressively to the common people. It will decide the fate of the nation in the upcoming 25 years when India will be completing 100 years of Independence.

Cover page of the Special issue of ‘Vigyan Pragati’ (August 2022)

At the end of the programme, Dr. Manish Mohan Gore, Scientist, CSIR-NIScPR and the Editor, Vigyan Pragati proposed vote of thanks. He presented the brief description of the special issue of the magazine. The special issue (August 2022) of the magazine includes public-funded institutions as well voluntary organizations working for science popularization across the country. He said some of the organizations felt the importance of science popularisation even before independence and started working on taking science to the common people. He assured that ‘Vigyan Pragati’ will work toward penetrating deep into the society so that science can be reached a larger audience of the country.

******

SNC/RR

Japan – MHI to Issue The Second Series of Transition Bonds

Hong Kong – FEHD clarifies issue of construction waste at Devil’s Peak

At the Kwun Tong District Council (DC) meeting yesterday (July 4), a DC member said that a report from the public was received claiming that staff of the Food and Environmental Hygiene Department (FEHD) had dumped construction waste at the slope after demolition of some illegal structures at Devil’s Peak. A spokesman for the FEHD clarifies today (July 5) that there had been no such incident as claimed.Hong Kong – Hongkong Post to issue “Dinosaurs” special stamps (with photos)

Hongkong Post announced today (October 31) that a special stamp issue and associated philatelic products on the theme of “Dinosaurs” will be released for sale on November 15 (Tuesday).

Dinosaurs are among the most spectacular and enigmatic species to have ever lived on Earth. They appeared as early as 230 million years ago and went extinct about 66 million years ago, after living on Earth for more than 160 million years. Since the discovery of dinosaur fossils in the 19th century, palaeontologists have devoted themselves to the study of dinosaurs in the hope of uncovering the truth about these prehistoric creatures and the lost world they once dominated. Hongkong Post will issue a set of six stamps, a souvenir sheet and associated philatelic products on the theme of “Dinosaurs”.

This set of six stamps features seven species of dinosaurs with distinctive characteristics from the Cretaceous period and the Jurassic period. The Cretaceous period saw the rise of flowering plants, with dinosaurs including tyrannosaurus, spinosaurus and triceratops ruling over the planet. During the Jurassic period, plants flourished and dinosaurs including diplodocus, brachiosaurus, allosaurus and hesperosaurus evolved in a warm climate.

Official first day covers for “Dinosaurs” will be put on sale at all post offices from tomorrow (November 1), and on Hongkong Post’s online shopping mall ShopThruPost (shopthrupost.hongkongpost.hk). This set of special stamps and associated philatelic products will be on sale at all post offices and ShopThruPost from November 15, while serviced first day covers affixed with the special stamps and postage prepaid picture cards (airmail) will be available at philatelic offices only.

A hand-back date-stamping service will be provided on November 15 at all post offices for official first day covers/souvenir covers/privately made covers bearing the first day of issue indication and a local address. To observe social distancing and to avoid people gathering at the post offices, collection points will be set up at all post offices on the same day for submission of the covers requesting the hand-back date-stamping service. Customers will be advised of the collection schedule upon acceptance of the covers.

Information about this set of special stamps and associated philatelic products is available on the Hongkong Post Stamps website (stamps.hongkongpost.hk) and in the “ShopThruPost” mobile app.

Special issue of ‘Vigyan Pragati’ released Today

(Release ID: 1853908)

Visitor Counter : 772