Synopsis

Starting a Systematic Investment Plan (SIP) early may not suffice for ambitious goals due to lower initial income and investment. However, a step-up SIP, which increases the investment amount over time, can significantly boosts the potential corpus. By escalating contributions annually, investors can generate substantially larger retirement funds, effectively combating inflation and securing a more comfortable future.

ET Online

ET OnlineIf your life goals are ambitious, starting an SIP even at the early part of your job and continuing it for life may not help you achieve it. This happens because your income is typically less at the beginning of your career and goal is relatively very big. However, as your income rise with time and you start investing bigger and bigger amount toward the goal your chances of achieving your life goal rises manifold. This is where a step-up SIP comes into the picture.

First, let’s discuss how SIP investment may help you create a corpus

Let’s assume you are 30 years old and in early part of your career with an Rs 40,000 monthly salary, where you can save and invest 30 per cent of your salary. It means you can start an Rs 12,000 monthly SIP investment with that amount. If you continue this investment for 30 years and get a 12% annualised return, you can generate an Rs 3.70 crore corpus.

Due to the power of compounding, the investment grew by more than 8.5 times of your investment, but because of inflation, it may be an insufficient amount for your retirement 30 years later. In such a case, a step-up SIP helps you beat inflation. If you start an Rs 12,000 monthly SIP investment and boost the amount by 8% every year, at a 12% annualised return, you can generate an Rs 7.61 cr corpus.

Such growth can help you beat inflation to a large extent.

How the calculation works for Rs 20,000 SIP

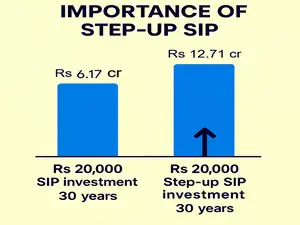

If you are a 30-year-old who starts an Rs 20,000 monthly SIP investment today, continues it for 30 years and gets 12% annualised growth, you can generate an Rs 6.17 cr retirement corpus.

But if you step up the same SIP amount by 8% annually, the corpus can be Rs 12.71 cr.

It means you may generate an additional corpus of Rs 6.54 crore.

Rs 20,000 Regular SIP vs Rs 20,000 Step up SIP

|

Corpus from Rs 20,000 SIP in 30 years |

Rs 6.17 cr |

|

Corpus from Rs 20,000 step up SIP in 30 years |

Rs 12.71 cr |

|

Extra corpus generated in 30 years |

Rs 6.54 cr |

Conclusion

When you are building a retirement corpus from an SIP investment, a long-term investment horizon, choosing the right amount and stepping it up can help you beat inflation and create a corpus for a comfortable retirement. However, choosing right investment is equally important and hence you need to consider equities which are known to deliver higher returns in the long run. For instance, one of the least risky mutual fund category is large cap mutual fund and it has delivered at an annual return of 12.16% for last 10 years as Value Research data dated 25 August 2025.