Synopsis

Filing Income Tax Return can be complex. For Assessment Year 2025-26, individuals with business income must use ITR-3. The Income Tax Department has introduced key changes. These include capital gains splits and asset reporting limit changes. Taxpayers must specify transfer dates for capital assets. Reporting requirements for virtual digital assets are also expanded.

ET Online

ET OnlineWhether you are a new taxpayer or a seasoned one, filing income tax return (ITR) can be confusing for you, especially if you are choosing the correct ITR form to use. For AY 2025-26 (FY 2024-25), individual taxpayers and Hindu Undivided Families (HUFs) having income from business or profession are required to file their income tax return using the ITR-3 form. The Income Tax Department (I-T) has introduced several key changes in the ITR-3 form this year.

Also read: ITR-3 Excel utility for AY 2025-26: Seven major changes in ITR-3 Excel utility that all taxpayers including stock traders should note

Who can file ITR-3 for AY 2025-26 (FY 2024-25)? Key changes and deadline

Individual and HUF taxpayers who have income from business or profession, partner of a firm, and individual taxpayers having gains and losses from futures and options or intraday trading can file the ITR-3 form. In Budget 2024, the ITR-3 form was updated to include the presumptive taxation provisions under Section 44BBC (cruise business) for income derived from business and profession.

According to chartered accountant Abhishek Soni, co-founder, Tax2Win, ITR-3 is to be used by either an individual or a Hindu Undivided Family who are carrying on a business or profession. The following persons are eligible to fill this form:

Which ITR form applies to your income for ITR filing FY 2024-25 (AY 2025-26) ITR-1, ITR-2, ITR-3 or ITR-4?

- If a person is a director of a company

- Persons who had investments in unlisted equity shares at any time during the entire financial year

- Having income from other sources

- Income of a person who is a partner in a firm

- Having income from salary or pension

- Having income from house property (one or more)

- Total income can exceed Rs 50 lakhs in this case

- Income earned from capital gains or foreign assets/foreign income

- Who has income under the head profits or gains of business or profession and who is not eligible to file Form ITR-1 (Sahaj), ITR-2, or ITR-4 (Sugam)

- The residential status can be either Non-resident or Resident (ROR/RNOR)

Key changes in ITR-3 form for AY 2025-26 (FY 2024-25)

According to the Income Tax Department, key updates for ITR-3 are:

- Schedule-Capital Gain split for gains before/after 23.07.2024 (post changes in Finance Act, 2024)

- Capital loss on share buyback allowed if corresponding dividend income is shown as income from other sources (post 01.10.2024)

- Asset & liability reporting limit raised to Rs 1 crore of total income

- Reference of Sec 44BBC (cruise biz) added

- Enhanced reporting for deductions [80C,10(13A)], etc.

- The TDS section code to be reported in Schedule-TDS

- The government has extended the due date for filing ITR from July 31, 2025, to September 15, 2025 for all those taxpayers for whom the original deadline was July 31. The deadline for taxpayers whose accounts are required to be audited is October 31, 2025.

What are the new changes in ITR-3 tax form?

SR Patnaik, Partner (head – taxation), Cyril Amarchand Mangaldas, highlights the important changes introduced in ITR-3 Form for AY 2025-26:

- The threshold for mandatory reporting of assets and liabilities has been increased to Rs 1 crore, easing the compliance burden for many taxpayers.

- Taxpayers now have to specify whether the transfer of a capital asset resulting in capital gains took place before or after July 23, 2024, as that would determine the applicable capital gains tax rates.

- ITR-3 also provides for reporting of consideration received from buyback of shares after October 1, 2024, as dividend income while allowing for corresponding cost of acquisition to be carried forward as capital losses.

- It provides for reporting of TDS under the specific Section under which tax has been deducted.

- There are detailed disclosure requirements for deductions claimed to offset taxable income.

- The reporting requirements for virtual digital assets have been expanded under ITR-3.

- The Excel utility has been updated to reflect these changes in the ITR-3 form.

Lessons from the Grandmasters

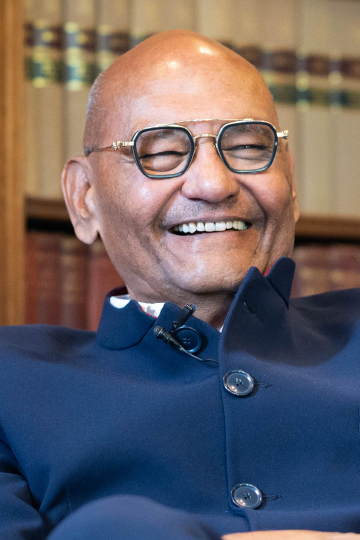

N.R. Narayana Murthy

Founder, Infosys

Watch Now

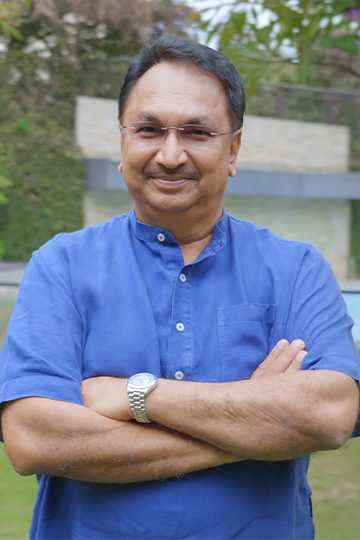

Harsh Mariwala

Chairman & Founder, Marico

Watch Now

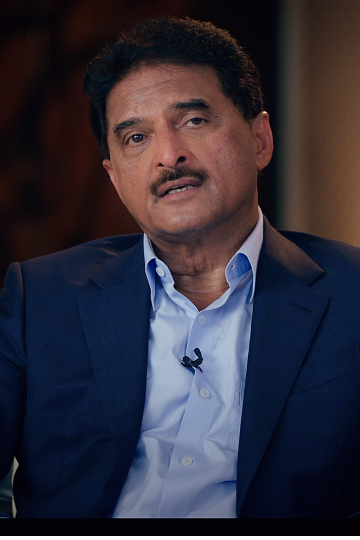

Adar Poonawalla

CEO, Serum Institute of India

Watch Now

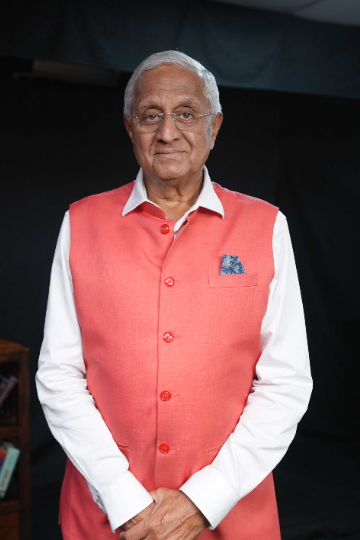

Ronnie Screwvala

Chairperson & Co-founder, upGrad

Watch Now

Puneet Dalmia

Managing Director, Dalmia Bharat group

Watch Now

Martin Schwenk

Former President & CEO, Mercedes-Benz, Thailand

Watch Now

Nadir Godrej

Managing Director, of Godrej Industries

Watch Now

Manu Jain

Former- Global Vice President, Xiaomi

Watch Now

Anil Agarwal

Executive Chairman, Vedanta Resources

Watch Now

Dr. Prathap C. Reddy

Founder Chairman, Apollo Hospitals

Watch Now

Vikram Kirloskar

Former Vice Chairman, Toyota Kirloskar Motor

Watch Now

Kiran Mazumdar Shaw

Executive Chairperson, Biocon Limited

Watch Now

Shashi Kiran Shetty

Chairman of Allcargo Logistics, ECU Worldwide and Gati Ltd

Watch Now

Samir K Modi

Managing Director, Modi Enterprises

Watch Now

R Gopalakrishnan

Former Director Tata Sons, Former Vice Chairman, HUL

Watch Now

Sanjiv Mehta

Former Chairman / CEO, Hindustan Unilever

Watch Now

Dr Ajai Chowdhry

Co-Founder, HCL, Chairman EPIC Foundation, Author, Just Aspire

Watch Now

Shiv Khera

Author, Business Consultant, Motivational Speaker

Watch Now

Nakul Anand

Executive Director, ITC Limited

Watch Now

RS Sodhi

Former MD, Amul & President, Indian Dairy Association

Watch Now

Anil Rai Gupta

Managing Director & Chairman, Havells

Watch Now

Zia Mody

Co-Founder & Managing Partner, AZB & Partners

Watch Now

Arundhati Bhattacharya

Chairperson & CEO, Salesforce India

Watch Now