Loans lab is a market-leading company in Auckland that offers a wide range of financial services that includes customized asset finance and insurance packages tailored for its esteemed clients.

The company combines state-of-the-art systems, knowledge, and great customer service that turn it into the most trusted financial service companies in Auckland.

This is one of the most trusted financial services companies in Auckland, which takes its clients by the hand and guides and helps them to choose the best combination of services to match their personal needs.

The proficient consultants of Loans Lab provide expert advice on wealth creation and investment strategies, mortgages and lending, estate planning, and debt and risk management. The company’s financial service expertise ranges across insurance planning, retirement, and aged care planning. It brings it all together with easy and affordable payment plans to suit the budget. Loans Lab takes you by the hand and guides you to choose the best combination of services to match your personal needs.

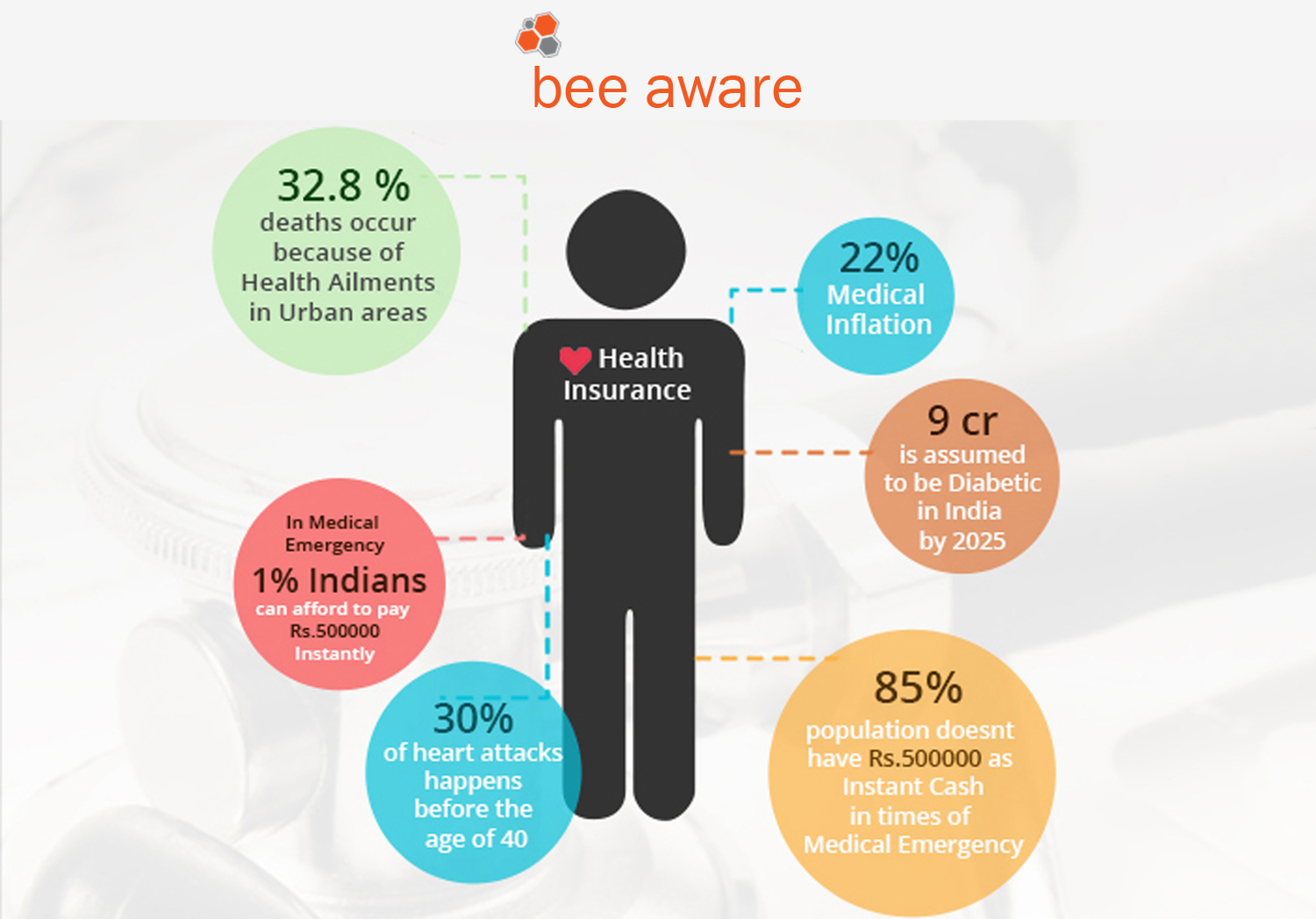

Loans Lab recognizes the fact that it becomes extremely overwhelming for an individual to understand the fine prints and wordings of an insurance policy. One finds difficulty to know how to increase wealth, compare and select the best insurance policy for their family, and reason out why you are paying more than your friend for the same coverage.

This is one of the best companies providing comprehensive personal Insurance in Auckland and is committed to rendering thoughtful value-added services and solutions that are flexible to tailor-make to the uniqueness of one’s personal needs. From Life insurance, health insurance, trauma, and disability insurance, Mortgage income protection, to ACC (Covering you in case of an accident) Loan Lab provides varieties of personal insurance in Auckland.

The company is tied up with the top-notch insurance providers like the Sovereign, Onepath, Fidelity Life, AIA, NIB, and Accuro, which supports you and your family for regular health, as well as the expenses associated with disability, critical illness, and long-term care.

The high experience and educational know-how of the financial advisers ensure that the clients only get quality advice so that they may attain their financial goals in a stress-free manner.