Recent News

Business

Moritek Beauty Collaborates with GR8T Magazine to Celebrate the Launch of the Ultimate Mori-Lift Mist in North America

Moritek Beauty collaborates with GR8T Magazine to celebrate the launch of the Ultimate Mori-Lift Mist for North America’s territory and the release of GR8T Magazine’s Spring 2024 Issue. The celebration took place at Room Service Beverly Center with the support of...

Wynona’s House Launches Annual Child Abuse Prevention Month Campaign to Promote Healing and Justice for Child Victims of Abuse and Neglect in Essex County

In honor of National Child Abuse Prevention Month, Wynona’s House Child Advocacy Center (CAC), alongside National Children's Alliance and other accredited CACs, is promoting the theme “It’s Your Business.” Wynona’s House launched its first digital billboard campaign...

Javier Ayala, PhD’s New Book, “Lifespan Leadership,” is an Intuitive Guide Designed to Help Readers Commit to Fostering Leadership Across All of Life’s Stages

Fulton Books author Javier Ayala, PhD, a leading figure in the realm of education and workforce development, has completed his most recent book, “Lifespan Leadership”: an insightful read that discusses proven and impactful leadership skills that cover a variety of...

Buy High Potent Products 35% Off On Exhale Wellness

Charlotte, NC – WEBWIRE – Friday, April 19, 2024 420, or April 20, is a special day for cannabis enthusiasts. While people in the US dont need a particular reason to hit a blunt nowadays, 420 sets off a festive mood for everyone who loves weed. This sale is a part of...

Dalal Street Investment Journal Launches “PSU Compendium 2018”

India Dalal Street Investment Journal’s (DSIJ) Managing Director, Rajesh V Padode, announced the launch of the “PSU Compendium 2018”, an annual compendium on Indian Public sector enterprises - The Building Blocks of the Country. The issue has been made available on...

Airtel Rolls out #PassTheTorch Campaign

New Delhi, Delhi, India Bharti Airtel (Airtel), India’s leading telecommunications service provider, today launched an innovative digital campaign #PassTheTorch to mark the 11th edition of the Airtel Delhi Half Marathon (ADHM). #PassTheTorch celebrates the spirit of...

Vahan Announces its AI-driven Assistant on WhatsApp to Automate Recruitment

Bengaluru, Karnataka, India Vahan, a Bengaluru-based company, has built an AI-driven virtual assistant integrated with WhatsApp that helps businesses automate various aspects of workforce engagement. To apply for a job, a candidate simply needs to send a “hi” message...

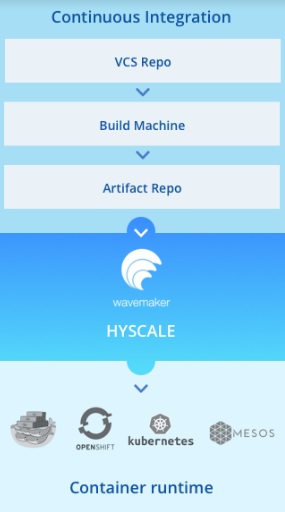

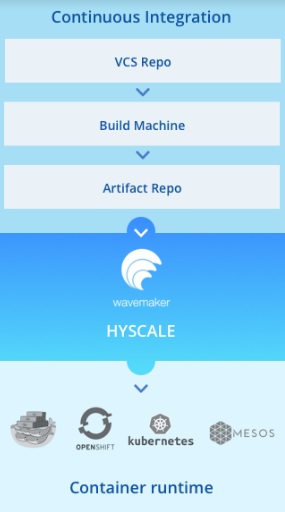

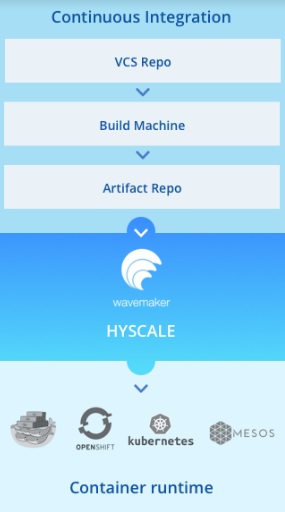

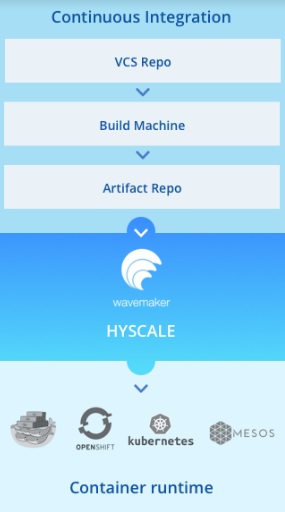

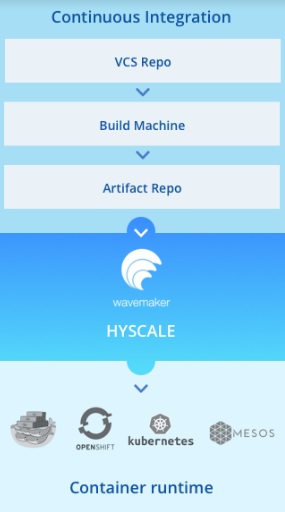

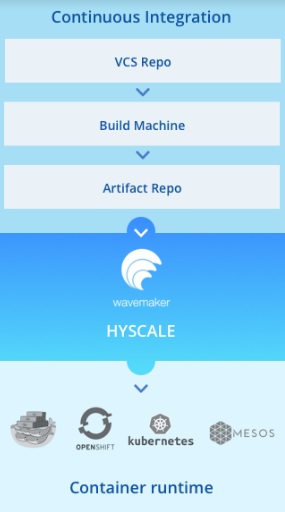

WaveMaker Launches HyScale

Mountain View, CA | Hyderabad, India WaveMaker Inc. / Pramati Technologies today launched WaveMaker HyScale, a continuous delivery automation platform that accelerates container adoption for large deployments in regulated industries like BFSI, healthcare, and telecom....

LIKE App Completes 1 Year in India; Clocks 70 Million Downloads Globally

Jul 30, 2018 13:50 IST New Delhi, Delhi, India LIKE, a breakthrough AR and AI bundled social video app landmarks its first year in India with 70 Million downloads, globally. In August 2017, LIKE tied up with popular Indian actor, Shahid Kapur, to launch the...

Upgrade Shower Doors in Greater Boston Now and Pay Later with IDEAL Shower Doors’ New Financing Plans

IDEAL Shower Doors, an established brand in shower door design and installation, is making luxurious bathroom renovations even more attainable for Greater Boston homeowners with its new, flexible financing options. These plans eliminate the financial hurdle, so...

General Device’s to Present Solution Suite at Michigan ENA 2024

Specifically, she will discuss and show all the ways that the GD Solution Suite, https://general-devices.com/gd-solution-suite/, improve coordination of emergency care by: Enabling live, HIPAA-secure communications between EMS and hospital teams through sharing...

BizWorld Updates Monthly Draper Innovation Index U.S. States Compete to Land in Top Ten of Best Places to Launch a Startup

California, long the symbol of global tech innovation leadership, fell to third place on our Tech Innovation scenario this month, behind Utah and now Colorado, said BizWorld founder Tim Draper. This reflects the long-term impact of the states economic policies and...

Investopedia Names INFINITI HR Best 2024 PEO for Large Businesses for the Fourth Year in a Row

A Washington Post Top Place to Work in 2022, INFINITI HR, was recognized among other professional employer organizations for handling businesss administrative, financial, and human resources (HR) needs including payroll, employee hiring, and benefits. NEW YORK, NY....

Traverse Bay Farms Unveils Six New Health and Wellness Videos to Empower Healthier Lifestyles

Traverse Bay Farms, an industry leader in providing all-natural gourmet food, is excited to announce the release of six new educational videos on their YouTube channel. Traverse Bay Farms, an industry leader in providing all-natural fruit-based products, is excited to...

Pioneering Nuclear Technology Firm, Curio, Closes $14 Million Seed Round to Drive Clean Energy Innovation

Curio, a Washington DC-based tech development company dedicated to advancing a closed fuel cycle, proudly announces the successful closure of its seed round with a total haul of $14 million. This achievement signifies a significant step forward in the company's...

Entertainment

Believe and Jjust Music Join Forces to Revolutionize Bollywood OST Market

Believe, one of the world’s leading digital music companies, and Jjust Music, an acclaimed new-age music label celebrated for its string of Indie music hits, have proudly announced a momentous partnership that will redefine the landscape of the Bollywood Original...

OKIE To Launch 32-inch Sports Series Smart TVs in South India as Demand Surges Amidst Upcoming 2023 Sports Season

Immersive Viewing Experience with 32”, 40”, and 43” Screens Full HD display and 4K Ultra HD resolution for crystal-clear images and vivid colours In-built voice control for seamless navigation 20-watt powerful sound output and built-in soundbars for immersive audio...

Jjust Music launches its first film song Jalsa 2.0, starring Akshay Kumar and Parineeti Chopra

Jjust Music, founded by the Bollywood Luminary and Producer, Jackky Bhagnani, is poised to set the stage ablaze with its inaugural original soundtrack (OST) for the much-anticipated cinematic masterpiece, "Mission Raniganj- The Great Bharat Rescue starring Akshay...

The ultimate celebration of India’s rock music scene: Mahindra Independence Rock unveils its line-up of 10 diverse rock acts for its 29th edition

Following last year’s triumphant return, where Mahindra Independence Rock (I-Rock) reclaimed its rich legacy, India’s legendary rock festival is gearing up to ignite the stage (and mosh pits) once more at Mumbai’s Bayview Lawns this year. This iconic festival’s...

Mark your calendar for the intensive 2-day tattoo workshop and take your skills to the next level!

Join us for an intensive 2-day tattoo workshop and take your skills to the next level! Explore business growth hacks, advanced tattooing techniques, and digital art concepts to enhance your craft. Hosted at Malad, this workshop will provide a unique opportunity to...

Amazon miniTV announces ‘Builders – An Inside story of a modern-day gym!

Amazon miniTV - Amazon’s free video streaming service has been a part of the hit parade with its path-breaking and diverse content library. Adding yet another feather to its hat, the streaming service today announced its latest show, Builders - a unique one-of-a-kind...

Gulf Coast Records’ Blues Music Award-Winner Mike Zito Set to Record New Album Sessions for Upcoming Life Is Hard CD Scheduled for February, 2024

Gulf Coast Records announces a February, 2024, release for the upcoming disc from multi-Blues Music Award-winner Mike Zito, to be titled Life Is Hard. Zito will record the new album September 18-22 during sessions at Sunset Sound Studios in Hollywood, California, with...

Noise announces introduction of Noise Junior, a dedicated smartwatch category for kids in India; launches Noise Explorer

Noise, India's No.1 smartwatch brand, has debuted Noise Junior, the brand's dedicated smartwatch category for kids. Being one of the first to identify the need for smart wearables for kids, Noise today unveiled this new category is tailor-made keeping the children and...

The ultimate celebration of India’s rock music scene: Mahindra Independence Rock unveils its line-up of 10 diverse rock acts for its 29th edition

Following last year's triumphant return, where Mahindra Independence Rock (I-Rock) reclaimed its rich legacy, India's legendary rock festival is gearing up to ignite the stage (and mosh pits) once more at Mumbai's Bayview Lawns this year. This iconic festival's...

DBZ Figure Son Goku Black Hair Version Gift

"DBZ Figure Son Goku Black Hair Version Gift" Celebrates the Legacy of Dragon Ball Z with a Unique Collector's Item Fans of the legendary Dragon Ball Z series have a reason to rejoice as [Your Company Name], a leading name in collectibles, unveils an exquisite new...

Sports

Chotrani, Anahat emerge champions

Maharashtra’s Veer Chotrani and Delhi’s Anahat Singh maintained their imperious form in the tournament, right till the end, lifting the men’s and women’s singles titles in the 6th Cello NSCI Open National Circuit squash tournament, hosted by NSCI at their glass backed...

magicpin Delivers on Its Promise: Office Signage Transformed into ‘Mahipin’ as MS Dhoni and CSK Triumph in IPL Final

Brace yourselves for the epic transformation that just took place at magicpin - India's first and largest hyperlocal startup headquarters in IFFCO Chowk at Gurugram. In a bold move, magicpin’s office signage has officially become 'Mahipin' to honor the incredible...

Chotrani ousts top seed Baitha to make men’s final

Maharashtra’s Veer Chotrani stormed into the men’s final with a dominating upset of top seed Rahul Baitha in the 6th Cello NSCI Open National Circuit squash tournament, hosted by NSCI at their glass backed squash courts, here, on Tuesday. The tournament is...

Sakib gets better of Chauhan to enters semis

Jamal Sakib of Services, seeded 5/8, scored a minor upset over his Services opponent Vaibhav Chauhan (3/4) to enter the men’s semi-finals of the 6th Cello NSCI Open National Circuit squash tournament, hosted by NSCI at their glass backed squash courts, here, on...

Singhva knock out top seed Achpal

Unseeded Naresh Singhva of Maharashtra pulled off the biggest win of his career when he knocked out top seed Adith Achpal of TN in the boys Under-19 pre-quarter-finals of the 6th Cello NSCI Open National Circuit squash tournament, hosted by NSCI at their glass backed...

JioCinema Equals the World Record for Concurrency Clocking 2.5 Cr Viewers During the Qualifier 1 between Gujarat Titans and Chennai Super Kings

JioCinema continued to set new benchmarks as it clocked 2.5 Cr. concurrent viewers during the Qualifier 1 of the TATA IPL 2023 match between Gujarat Titans and Chennai Super Kings. JioCinema not only broke its own record for the third time this season but also...

adidas is unveiling Move For The Planet

Today, adidas is unveiling Move For The Planet; a new global initiative that will harness the collective activity of sporting communities across the world. adidas is encouraging people to turn activity into action as it pledges to donate €1 to Common Goal for every 10...

adidas and Arsenal reveal the Arsenal home jersey

Today, adidas and Arsenal reveal the Arsenal home jersey for the 2023/24 season, marking the 20th anniversary of the ‘Invincibles’ season with a bold new look. Taking design inspiration from the kit worn by the record-breaking team, the jersey features a new shade of...

Reebok launches ‘I am the New’ brand campaign, ropes in leading actor Taapsee Pannu and World’s No. 1 T20 batter Suryakumar Yadav as brand ambassadors

Reebok, a brand synonymous with sports and fitness, has announced a new chapter in its journey. Under the aegis of Aditya Birla Fashion and Retail Limited (ABFRL) in India, Reebok is re-establishing itself as a leading sports and performance brand with a powerful new...

TATA IPL 2023 on JioCinema Clocks a Record-Breaking 1300 Cr. + Video Views in the First Five Weeks

JioCinema, the Official Digital Streaming Partner of TATA IPL 2023, continues to set global benchmarks in the world of digital sports viewing as it clocked over 1300 Cr. video views in the first five weeks. Viewers were glued to JioCinema’s fan-centric presentation as...

Philips Avent encourages mothers to comeback their way with Sania Mirza; launches #AskAvent – a knowledge hub for breastfeeding mothers

Motherhood is one of the most sacred and revered roles that a woman can take on and the journey is even more incredible. However, it comes with its unique set of challenges that can often make it difficult for mothers to pursue their passions and careers. After having...

Pradhan, Gawate win Federal Bank Kochi Marathon 2023

Uttarakhand's Arjun Pradhan and Maharashtra long-distance runner Jyoti Gawate won the inaugural Federal Bank Kochi Marathon 2023, which was organized by CleoSportz, and held here on Monday. Arjun Pradhan, who was the favourite in the men's elite category, emerged...

This 19 years old Three-Star Wide Receiver Deserves Your Attention

There are always players that don’t end up getting the attention they rightfully deserve in both college and professional sports. Here we are hoping to change that regarding one player in particular, DeVante Perkins. Perkins is a name that, if you aren’t already...

National Lacrosse League Announces Information For 2022 Entry Draft

The National Lacrosse League (@NLL), the largest and most successful professional lacrosse property in the world, today announced that the 2022 NLL Entry Draft will be held on Saturday, September 10 at 2 p.m. ET at the historic The Carlu in downtown Toronto....

Joe Moore Award Becomes First Post-Season College Award Platform To Launch NIL Program

The Foundation for Teamwork, owners and creators of the Joe Moore Award (@joemooreaward) which honors the most Outstanding Offensive Line Unit in College Football, today announced that it is believed to be the first post season college award program to launch a Name...

Interviews & Features

Blackjack Review 2022 For Online Gambling- Gambling Sites Club

You’ve probably heard that learning blackjack takes a minute and mastering it takes a lifetime. It’s only fair, because blackjack online is a fantastic game! Right? Let’s take a closer look at this contentious game. What is Online Blackjack Gambling? Blackjack is a...

3 Reasons Why It is a Must to Hire an eCommerce Design Agency

While Considering the website composition and manner in which a web-based store looks, typically the creative viewpoints ring a bell. How a specific picture looks or the varieties that are being utilized. These are absolutely significant components, however there are...

Year Ender Quotes | Women Entrepreneurs

Malini Agarwal- Founder & Creative Director MissMalini Entertainment & Girl Tribe From the onset of the pandemic there has been a spotlight on influencer marketing as a crucial part of the marketing mix. The rapid growth of the creator ecosystem over the last...

‘Puressentiel Purifying Air Spray’ an essential requirement for your home

Pollution has been a concern for us Indians more so over the past few years with the AQI rising above hazardous. It is well known that outdoor polluted air can cause irreversible damage to the respiratory system. However Indoor air pollution is 100 times more...

Recipe – CORNITOS AVOCADO MINI WAFFLES WITH DRAGON FRUIT AND AVOCADO SALSA

Avocado Mini Waffles: Ingredients: For the avocado filling: 1/2 mashed avocado 1/4 cup grated paneer 1 tbsp chopped onion 2 chopped garlic cloves 1/2 chopped green chilli 1/2 tsp mixed herbs 1 tbsp chopped coriander 1/2 tsp lemon juice Salt to taste For waffles:...

Card91 appoints Srijit Sanyal as Vice President, Sales

Card91, a payment infrastructure platform, has appointed Srijit Sanyal as Vice President, Sales & Partnership. A veteran in the Fintech industry, Srijit has nearly 2 decades of rich sales experience with banks, fintechs and pharmaceuticals and has held senior...

All News

Moritek Beauty Collaborates with GR8T Magazine to Celebrate the Launch of the Ultimate Mori-Lift Mist in North America

Moritek Beauty collaborates with GR8T Magazine to celebrate the launch of the Ultimate Mori-Lift...

Wynona’s House Launches Annual Child Abuse Prevention Month Campaign to Promote Healing and Justice for Child Victims of Abuse and Neglect in Essex County

In honor of National Child Abuse Prevention Month, Wynona’s House Child Advocacy Center (CAC),...

Javier Ayala, PhD’s New Book, “Lifespan Leadership,” is an Intuitive Guide Designed to Help Readers Commit to Fostering Leadership Across All of Life’s Stages

Fulton Books author Javier Ayala, PhD, a leading figure in the realm of education and workforce...

Hong Kong – Hong Kong Customs seizes suspected dangerous drugs worth about $1.1 million (with photo)

Hong Kong Customs seizes suspected dangerous drugs worth about $1.1 million (with photo)...

Hong Kong – Education Bureau alerts schools and public to bogus phone call

Education Bureau alerts schools and public to bogus phone call...

Hong Kong – Speech by SCST at opening reception of Trevor Yeung: Courtyard of Attachments, Hong Kong in Venice (English only) (with photo)

Speech by SCST at opening reception of Trevor Yeung: Courtyard of Attachments, Hong Kong in Venice...

Hong Kong – Electoral Affairs Commission Report on 2023 District Council Ordinary Election published

Electoral Affairs Commission Report on 2023 District Council Ordinary Election published...

NSE to launch derivatives on Nifty Next 50 Index (NIFTYNXT50) from April 24, 2024

National Stock Exchange of India (NSE), the world’s No 1 derivatives exchange in the year...

LTIMindtree Collaborates with Vodafone to Deliver Connected, Smart IoT and Industry X.0 Solutions

LTIMindtree [NSE: LTIM, BSE: 540005], a global technology consulting and digital solutions...

Axis AMC elevates R Sivakumar to Head of Corporate Strategy

Axis AMC, one of the fastest growing fund houses in the country, is pleased to announce that R...

ABP News Launches ‘Jeetna Aapka Zaroori Hai’ Campaign, Inspiring Voter Empowerment Ahead of 2024 General Elections

As India's monumental democratic exercise unfolds with the voting process for the 18th Lok Sabha...

Honda Racing India riders gear up for Round-2 of 2024 Asia Road Racing Championship in China

After an adrenaline-charged debut in the 2024 Asia Road Racing Championship in Thailand, the...

Air India Express ties up with AISATS for AeroWash Automated Aircraft Exterior Cleanings

Air India SATS Airport Services Private Limited (AISATS), India’s leading airport services...

NPCI Bharat BillPay Partners with SBI to Introduce NCMC Recharge as a New Biller Category

In a bid to further enhance the convenience for travellers, NPCI Bharat BillPay Limited (NBBL), a...

Honda Motorcycle & Scooter India inaugurates new CKD Engine Assembly Line at Global Resource Factory, Manesar (Haryana)

Honda Motorcycle & Scooter India (HMSI), one of the country’s leading two-wheeler...

Buy High Potent Products 35% Off On Exhale Wellness

Charlotte, NC – WEBWIRE – Friday, April 19, 2024 420, or April 20, is a special day for cannabis...

Dalal Street Investment Journal Launches “PSU Compendium 2018”

India Dalal Street Investment Journal’s (DSIJ) Managing Director, Rajesh V Padode, announced the...

Airtel Rolls out #PassTheTorch Campaign

New Delhi, Delhi, India Bharti Airtel (Airtel), India’s leading telecommunications service...

Vahan Announces its AI-driven Assistant on WhatsApp to Automate Recruitment

Bengaluru, Karnataka, India Vahan, a Bengaluru-based company, has built an AI-driven virtual...

WaveMaker Launches HyScale

Mountain View, CA | Hyderabad, India WaveMaker Inc. / Pramati Technologies today launched...

LIKE App Completes 1 Year in India; Clocks 70 Million Downloads Globally

Jul 30, 2018 13:50 IST New Delhi, Delhi, India LIKE, a breakthrough AR and AI bundled social...

Upgrade Shower Doors in Greater Boston Now and Pay Later with IDEAL Shower Doors’ New Financing Plans

IDEAL Shower Doors, an established brand in shower door design and installation, is making...

General Device’s to Present Solution Suite at Michigan ENA 2024

Specifically, she will discuss and show all the ways that the GD Solution Suite,...

BizWorld Updates Monthly Draper Innovation Index U.S. States Compete to Land in Top Ten of Best Places to Launch a Startup

California, long the symbol of global tech innovation leadership, fell to third place on our Tech...

Investopedia Names INFINITI HR Best 2024 PEO for Large Businesses for the Fourth Year in a Row

A Washington Post Top Place to Work in 2022, INFINITI HR, was recognized among other professional...

Contribute to Web Newswire

Access Premium Content

You can access and use the content for free on your website if you give an attribution and linkback to us.

Thanks for supporting us!

Contribute your Content

PR Agencies, Brands and others can contribute your content with us for free. This will now be subject to editorial approval. (5pm-6pm IST, All Days in a Week)

Follow Us

Please link us using RSS. We have stopped updating social medias channels for updates so that we can focus on quality content that is more useful for all of us.